Bond Offering

Bond Offering Structure – via Special Purpose Vehicle (BVI)

The British Virgin Islands are becoming an increasingly popular jurisdiction for establishing asset holding entities, and in particular, special purpose vehicles (“SPVs”) for use in asset-backed financing transactions.

Structure

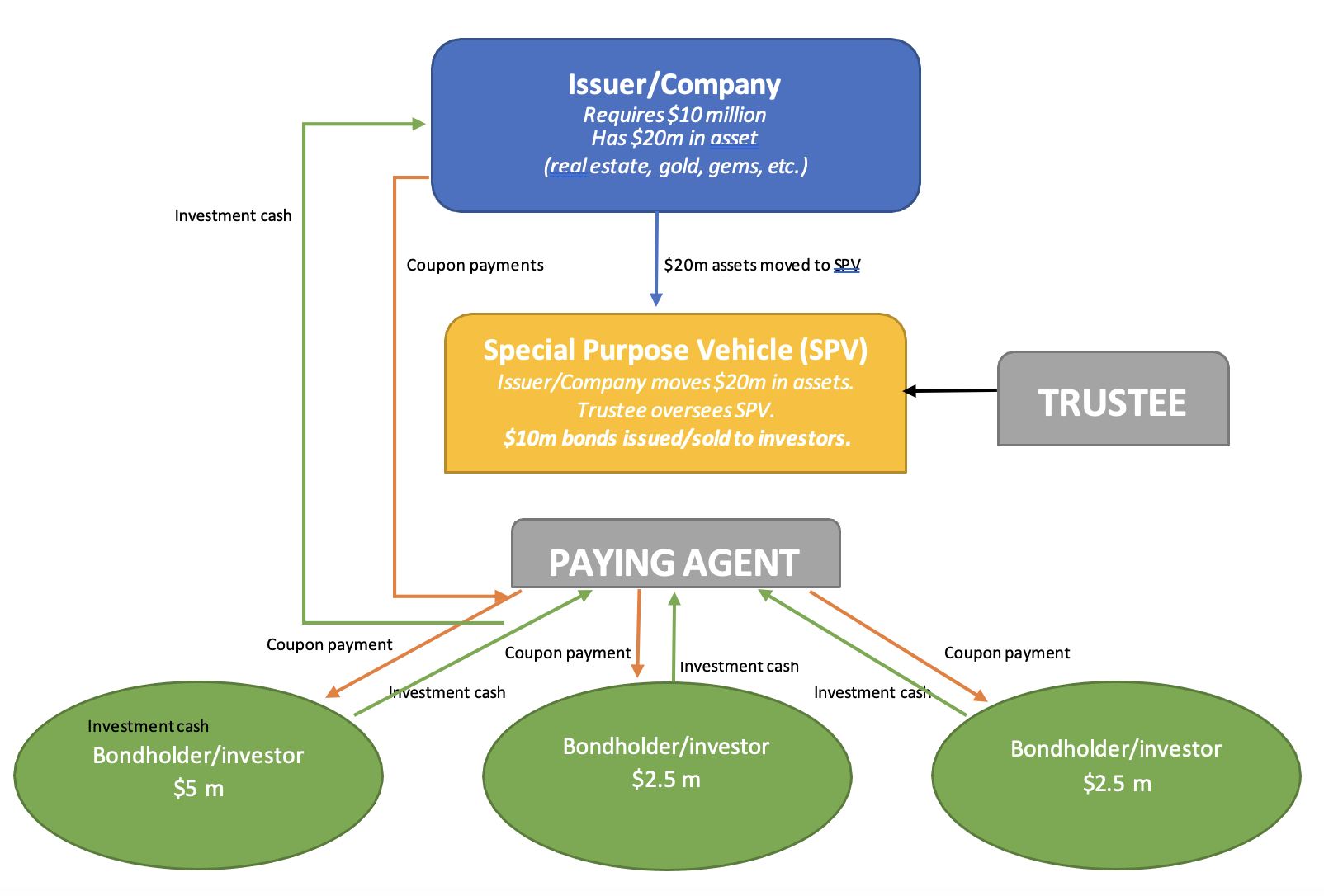

In this particular asset-backed bond offering, the transaction will involve the company/issuer transferring ownership of the asset to an independent company that is set up in the British Virgin Islands (BVI) for their asset. The asset is now utilized as a security in the SPV and is pledged in favor of new bondholders who will provide the capital to the underlying issuer/sponsor of the SPV.

The directors of the SPV are often independent trustees provided by a dedicated corporate services provider with experience in securitization structures.

The Parties involved:

• Arranger or lead manager (licensed investment bank in the Cayman Islands – i.e. TCI Capital Markets). These are appointed by the issuer to arrange the issue of debt securities and manage the issue process, including the structure, timing and pricing of the issue.

Documents

The main documents produced when issuing and listing debt securities are: